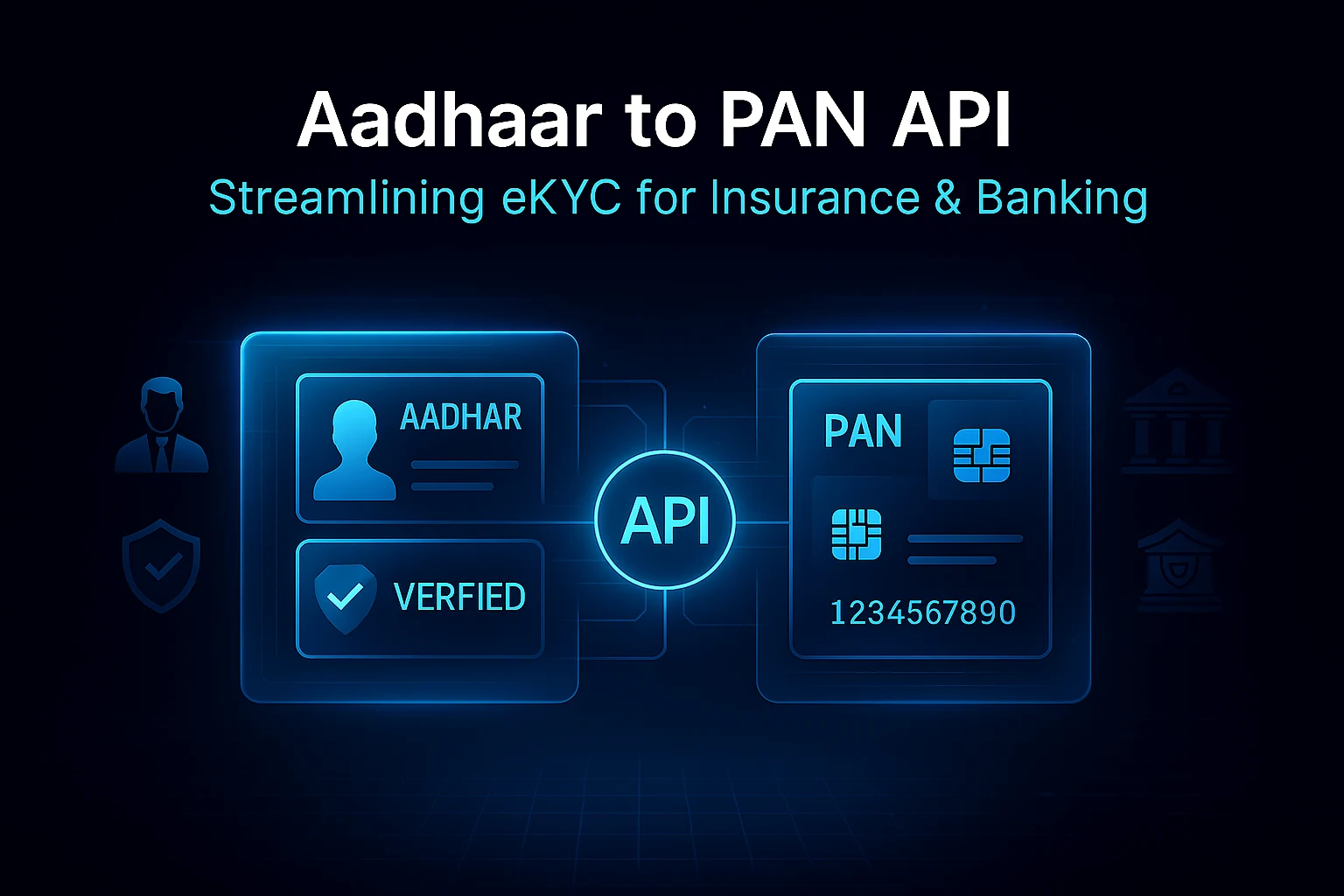

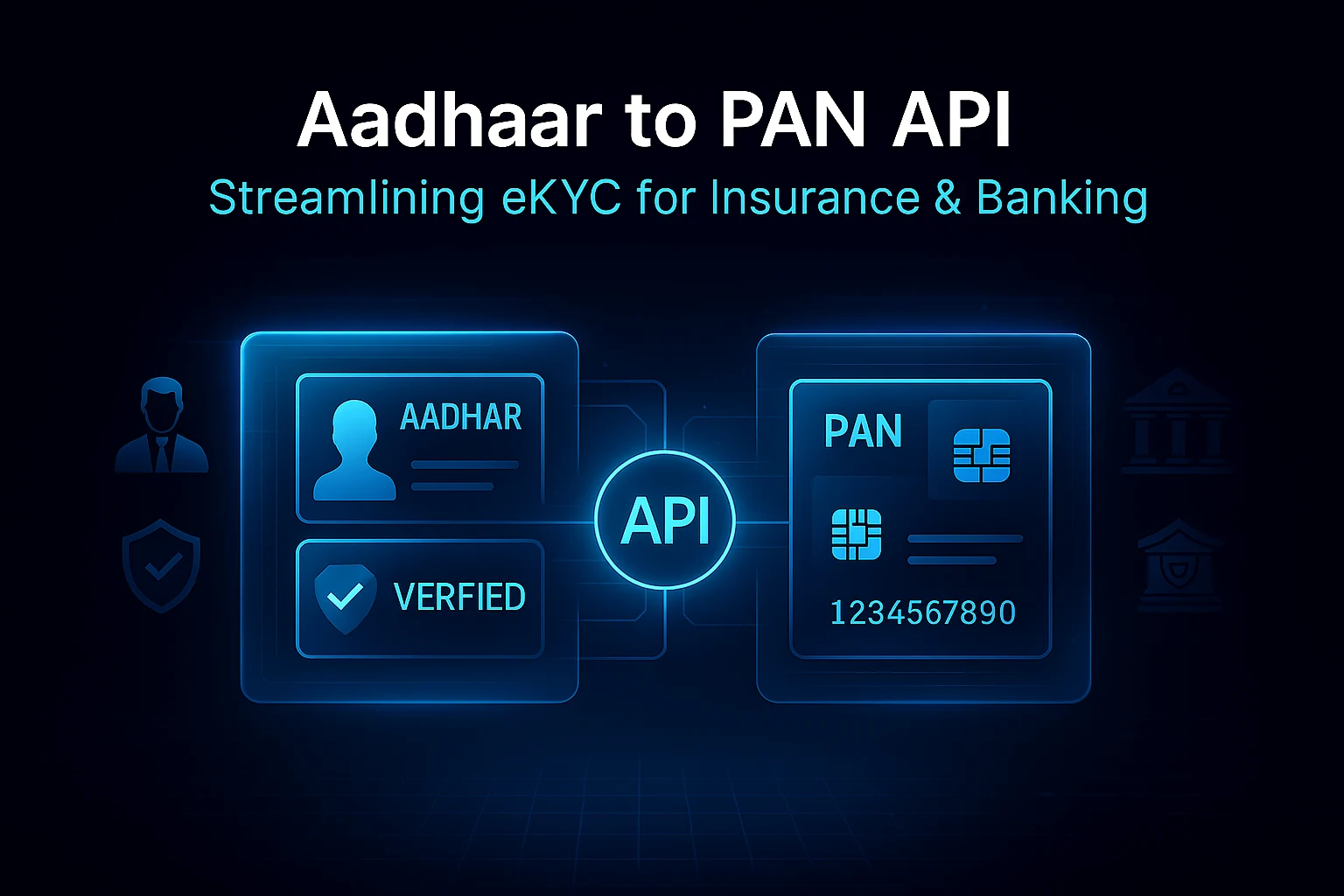

Aadhaar to PAN API: Streamlining eKYC for Insurance & Banking

Back to Blogs

Identity verification has always been a slow and paper-heavy process in finance. Even if it's opening a new bank account or purchasing an insurance policy, customers always find themselves waiting for manual checks and document reviews. This long-drawn process not only frustrates users but also slows down businesses.

Now, a quiet digital revolution is changing that. The introduction of the Aadhar to PAN API is helping banks and insurers verify customers instantly no paperwork, no physical visits, and no long waiting times. It’s making Aadhaar-based eKYC faster, smarter, and simpler than ever before.

Banking and insurance providers rely heavily on KYC verification to establish customer identity. But as customer expectations have evolved, so has the need for faster, more reliable digital solutions.

Aadhaar-based KYC verification allows businesses to confirm a person’s identity using their Aadhaar number. When this data is linked with a customer’s PAN through Aadhaar PAN API integration, the entire KYC process becomes instant and error-free.

Instead of scanning and submitting multiple documents, a customer can now complete onboarding in seconds. This is automated KYC verification at its best secure, accurate, and efficient.

Every financial transaction, from opening a bank account to investing in insurance, requires identity and tax verification. Aadhaar represents personal identity, while PAN connects to financial records. When these two are linked using an API, it ensures that the data provided is consistent and valid.

The Aadhaar to PAN API makes this cross-verification process fully digital. Businesses can now integrate the API within their onboarding systems and automatically check if a customer’s Aadhaar and PAN belong to the same person.

This process helps detect mismatched details, eliminates duplicates, and allows instant verification without any manual input. For example, a digital bank can use the API to verify customer identity before account creation. Once the Aadhaar and PAN match, the account setup continues automatically, saving both time and effort.

Aadhaar-based eKYC has become the foundation of digital onboarding across industries. It uses the Aadhaar database to confirm identity details, such as name, date of birth, and address, almost instantly.

When combined with Aadhaar PAN API integration, it allows financial and insurance providers to complete eKYC in seconds. This integration ensures that the person applying for a service is genuine and that their identity details match perfectly.

For instance, when a customer applies for a life insurance policy online, the insurer can verify their identity and financial record simultaneously. The insurance KYC process that once took days can now be completed in minutes all through automated verification.

Manual verification often leads to errors and delays. But with automated KYC verification, businesses can perform identity checks automatically through system integrations.

A bank that integrates banking KYC automation into its digital platform can process hundreds of applications simultaneously without increasing staff workload. Similarly, an insurance provider using automation can onboard new customers 24/7 without manual reviews.

Automation not only saves time but also ensures accuracy. Since data is validated in real time, the chances of human error are nearly eliminated.

APIs have become the backbone of modern KYC systems. A company can now plug in an aadhar card verification api to instantly validate a customer’s Aadhaar details. This small but powerful integration helps confirm that the Aadhaar number is real and active.

Likewise, businesses can use aadhar pan card link check online to confirm whether both identity numbers are properly linked. This check helps avoid mismatches and ensures smooth processing for loans, insurance, and account openings.

These APIs can be embedded into web or mobile applications, allowing instant results while keeping the experience simple for customers.

Speed is everything in customer onboarding. Waiting hours or days for verification always leads to drop-offs. That’s where instant KYC verification makes the biggest impact.

Through real-time data exchange between Aadhaar and PAN databases, verification happens instantly. Customers applying for financial services get approval in seconds no scanning, no uploads, and no manual reviews.

This instant validation boosts customer satisfaction and helps businesses onboard users faster. It also minimizes fraud by ensuring that the person’s identity and financial records are genuine.

In the banking sector, banking KYC automation driven by Aadhaar and PAN APIs is setting a new standard. Digital banks and fintech platforms can onboard new customers directly through their apps, performing eKYC without human intervention.

For example, when a user applies for a new credit card, the system can automatically check Aadhaar and PAN details using the API. Once verified, the application moves to approval instantly. The result? Faster onboarding, lower operational costs, and higher customer trust.

Insurance providers have also adopted Aadhaar-based KYC verification to enhance the insurance KYC process. Instead of collecting photocopies or in-person documents, insurers can now verify identity and tax information through API-based checks.

A user buying a term plan online simply enters their Aadhaar and PAN numbers. Within moments, the system verifies both, completes the KYC, and issues the policy digitally. This convenience not only improves efficiency but also delivers a smoother, more transparent experience for customers.

The Aadhaar to PAN API has transformed KYC from a slow manual task into an automated digital process. Its ability to verify identities instantly helps businesses reduce turnaround times, improve accuracy, and enhance customer experience.

By leveraging Aadhaar-based eKYC, automated KYC verification, and instant KYC verification, banks and insurers can serve customers faster than ever before. These innovations prove that seamless onboarding isn’t a luxury anymore it’s an expectation.

Customer identity verification doesn’t have to be complicated or time-consuming. With the Aadhar to PAN API, banks and insurance companies can now deliver quick, accurate, and digital onboarding experiences.

Whether it’s banking KYC automation or the insurance KYC process, integrating APIs for Aadhaar and PAN has made verification simple, secure, and instant. By using tools like the aadhar card verification api and aadhar pan card link check online, businesses can bring true efficiency to their eKYC systems.

In a world where every second counts, Aadhaar-based KYC verification gives financial institutions the edge they need for faster onboarding, happier customers, and smoother operations powered by digital intelligence.

To integrate the Aadhaar to PAN API and enable instant KYC verification in your system, reach out to our team at business@apimall.in or visit Contact Us for more details.