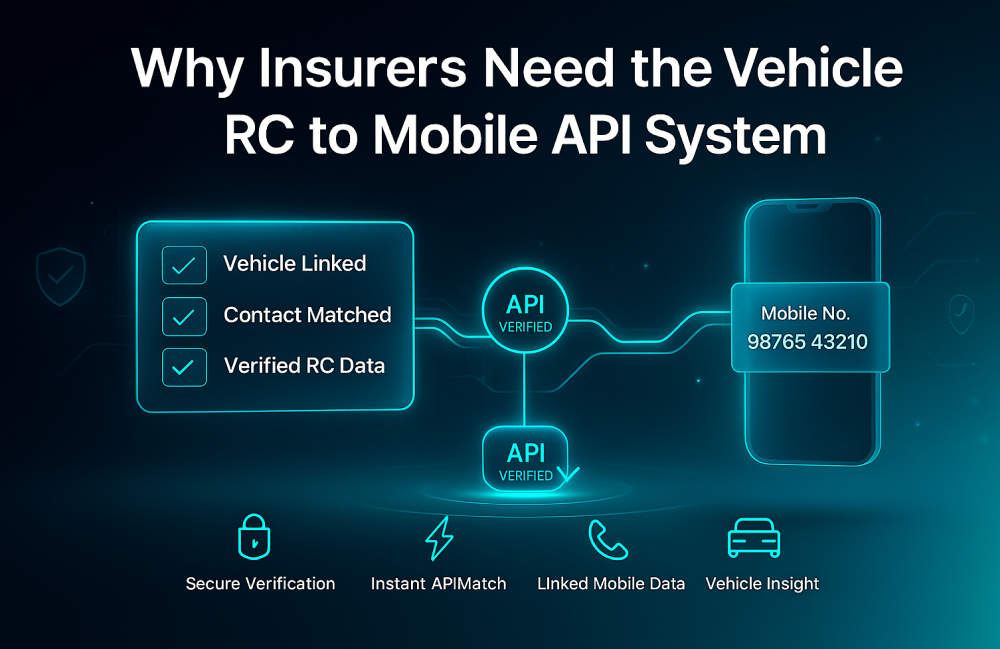

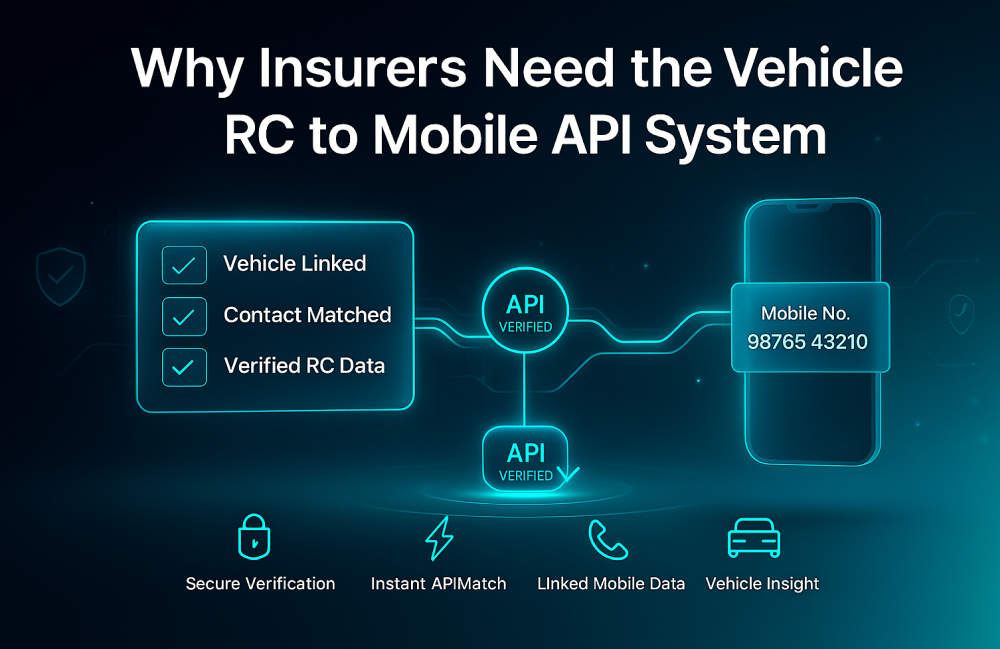

Why Insurers Need the Vehicle RC to Mobile API System

Back to Blogs

Insurance companies depend on accurate information to issue policies check claims and verify customers. When the contact number linked to a vehicle’s RC is wrong or outdated the entire insurance workflow slows down. Reaching the owner becomes difficult delays increase and fraud risks rise.

This is why insurers now rely on the Vehicle RC To Mobile Number API a tool that instantly connects RC details with the correct mobile number. With one quick search insurers get the vehicle owner contact from RC helping them move faster stay accurate and avoid common verification issues.

Earlier insurers depended on documents submitted by customers. These details were often incomplete incorrect or outdated. The Vehicle RC mobile number API changes this by giving insurers verified real-time data.

It ensures that the person applying for a policy renewing a policy or submitting a claim is the actual owner of the vehicle. When used together with a Vehicle Insurance API the verification becomes even stronger and more automated across the entire workflow.

Insurance teams deal with thousands of applications and claims every day. When they do not have the correct mobile number linked to the RC everything slows down. The Vehicle RC To Mobile Number API helps insurers:

With trusted data insurers avoid confusion and reach customers quickly.

The system is simple. An insurer enters the vehicle number and the RC mobile number finder API returns the mobile number linked to it. This data comes from trusted sources so it is accurate and updated. It helps insurers match the RC details with the correct phone number ensuring the customer is genuine.

If a person applies for a policy or files a claim the API confirms whether the RC truly belongs to them. This check prevents fake entries and ensures a smooth verification experience. When paired with the Vehicle Insurance API this combined verification improves both policy accuracy and claim management.

Insurance fraud often involves fake RCs incorrect contact details and wrong ownership claims. This creates financial risks and slows down processes. The RC KYC verification API helps insurers detect fraud early by verifying:

Since the details come directly from verified data sources insurers can trust the results and stop fraudulent submissions before they reach later stages. Adding a Vehicle Insurance API further strengthens detection by validating policy details and linking them with verified RC records.

Claims require fast communication inspections and document checks. If the insurer is calling the wrong number the entire claim process gets delayed. With RC details with mobile numbers insurers can:

Accurate contact details help insurers close claims faster and more efficiently.

During policy creation insurers must confirm ownership and customer details. Customers may sometimes provide old or incorrect phone numbers. With mobile number from vehicle number lookup insurers can cross-check and verify the correct number linked to the RC.

This prevents errors in policy data and ensures smooth renewals because the insurer always reaches the right person. It also reduces back-and-forth communication during onboarding. The Vehicle Insurance API helps link coverage details with verified RC data preventing mismatches and claim disputes.

Many policy-related delays happen because customers have not updated their RC details. People often ask how to update mobile number in vehicle RC online or how to update mobile number in RC online but the update process may take time. Until the user updates their official RC information insurers still need a way to reach them.

The API solves this gap by giving insurers the latest mobile number available in the RC database. This ensures smooth communication even when the customer forgets to update their details manually.

The Vehicle RC To Mobile Number API is helpful across multiple insurance operations:

When combined with a Vehicle Insurance API insurers can automate both vehicle verification and policy validation creating a smoother end-to-end workflow.

For insurers having a verified mobile number linked to the RC is more than just a contact detail—it becomes a crucial part of decision-making. When the data is correct insurers can connect the right vehicle to the right owner with confidence.

This improves internal coordination and speeds up tasks such as policy approvals document reviews claim checks and customer communication. It also removes the guesswork that often slows down insurance teams. With verified data from the Vehicle RC To Mobile Number API insurers build a clean reliable foundation for every workflow making their operations smoother and safer.

Accurate RC-to-mobile mapping allows insurers to:

Real-time access helps insurers manage workflows effectively and avoid delays caused by incorrect contact information. Combined with insurance APIs insurers gain a secure complete and connected verification process.

Insurers need fast correct and verified data to handle policies renewals and claims. The Vehicle RC To Mobile Number API gives them exactly that by connecting RC details with accurate mobile numbers in real time. With features like fraud detection quicker onboarding smoother claim handling better KYC verification and improved policy accuracy through the Vehicle Insurance API this system has become essential for insurance operations.

For insurers aiming to improve accuracy and deliver a better customer experience the RC-to-Mobile API system is now a must-have tool. To integrate this solution into your workflows or request a demo contact us or reach out at sales@apimall.in for support.